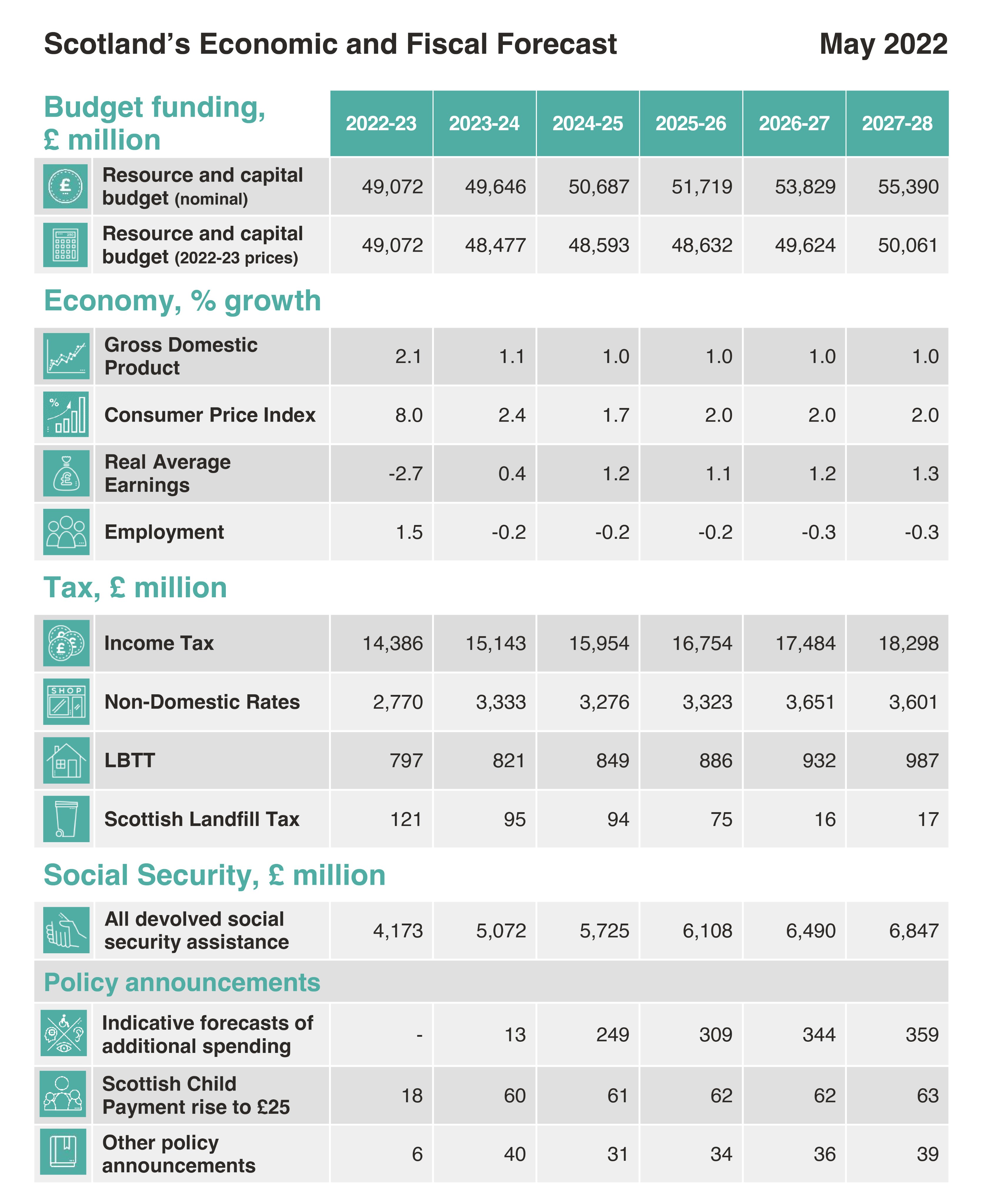

income tax rates 2022/23 scotland

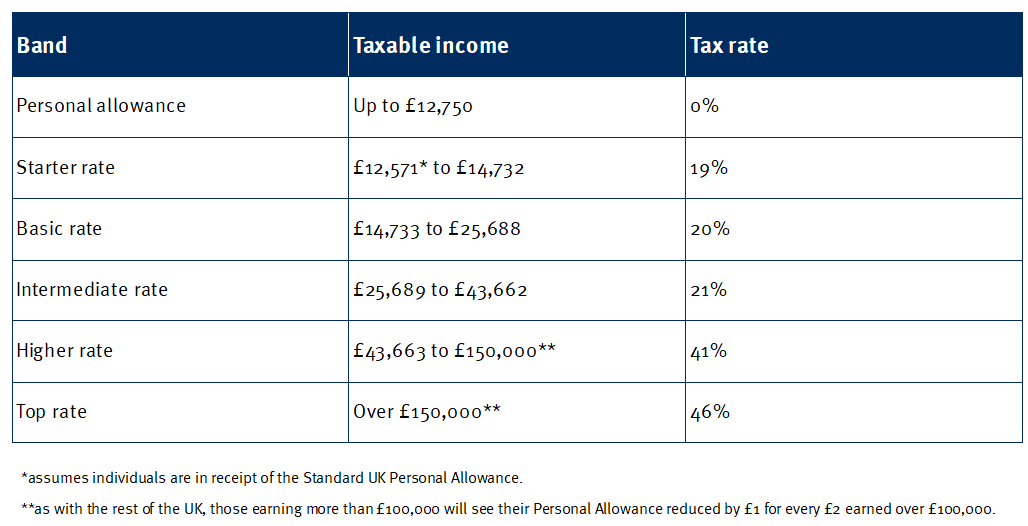

Tax Rates and Allowances 202223 Income tax rates - Scotland 202223 202122 Scottish resident taxpayers are liable on non-savings and non-dividend income as set out below. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Payroll Year End Bulletin Spring 2022 Henderson Loggie

Scottish income tax bands 202223.

. Band Taxable income Tax rate. A Scottish taxpayer with total income of 50000 assuming this is all earned income will have a tax liability of 897510 in 202223 personal allowance of 12570. At the Scottish Budget on 9 December 2021 the Cabinet Secretary for Finance and the Economy set out the proposed Scottish Income Tax rates and bands for 2022 to.

ICalculator Scottish Tax Calculator is updated for the 202223 tax year. If you wish to calculate your income tax in Scotland before the income tax rate change in 201718 you can use the pre 201718 Scottish Income Tax Calculator. About 48 of Income Tax is paid by male Higher and.

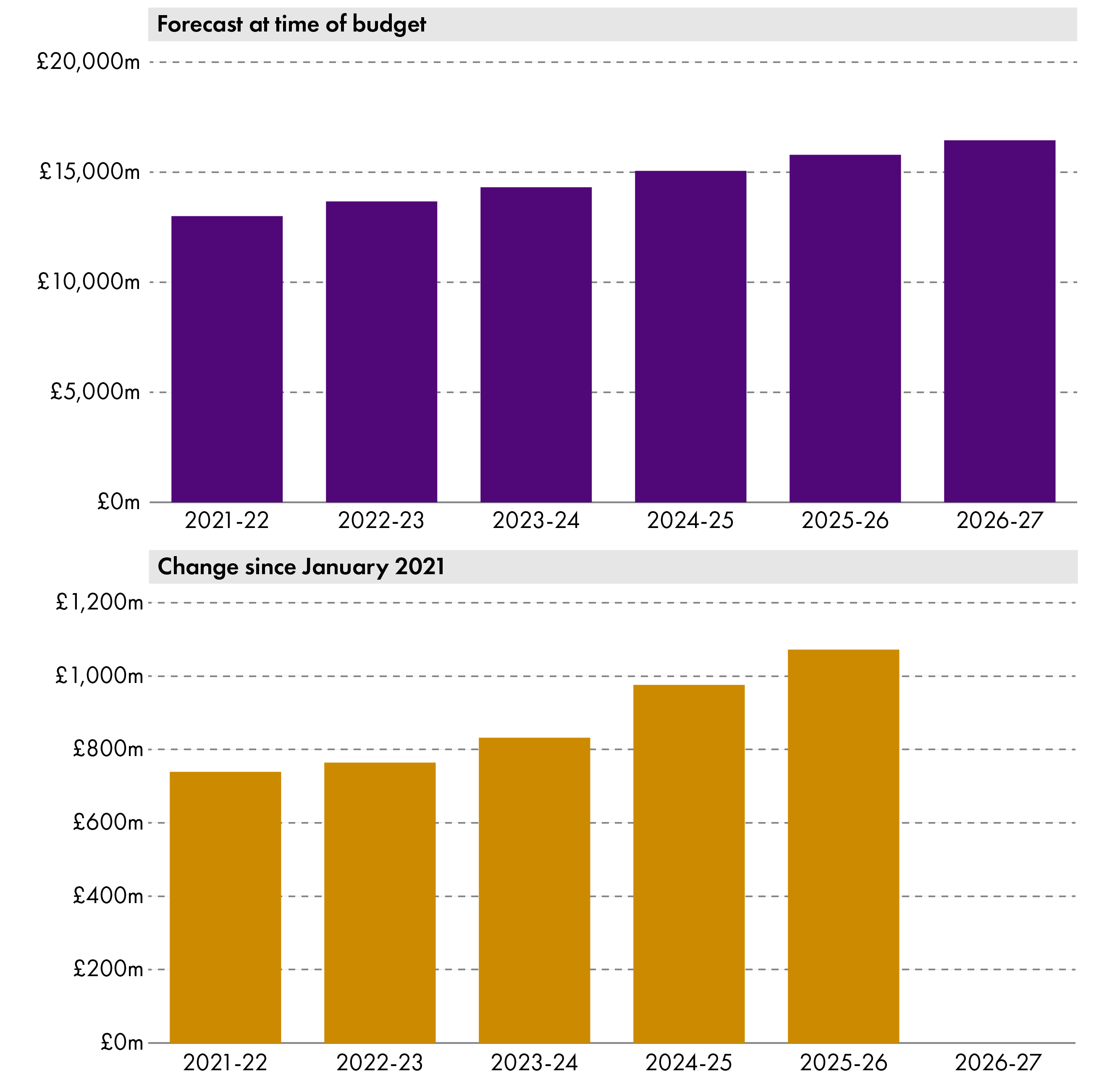

The Scottish Governments latest published accounts are for 2020-21 and they were given a clean. As a result male taxpayers are expected to contribute around 69 to total Income Tax liabilities in Scotland in 2022-23. Income tax bands are different if you live in Scotland.

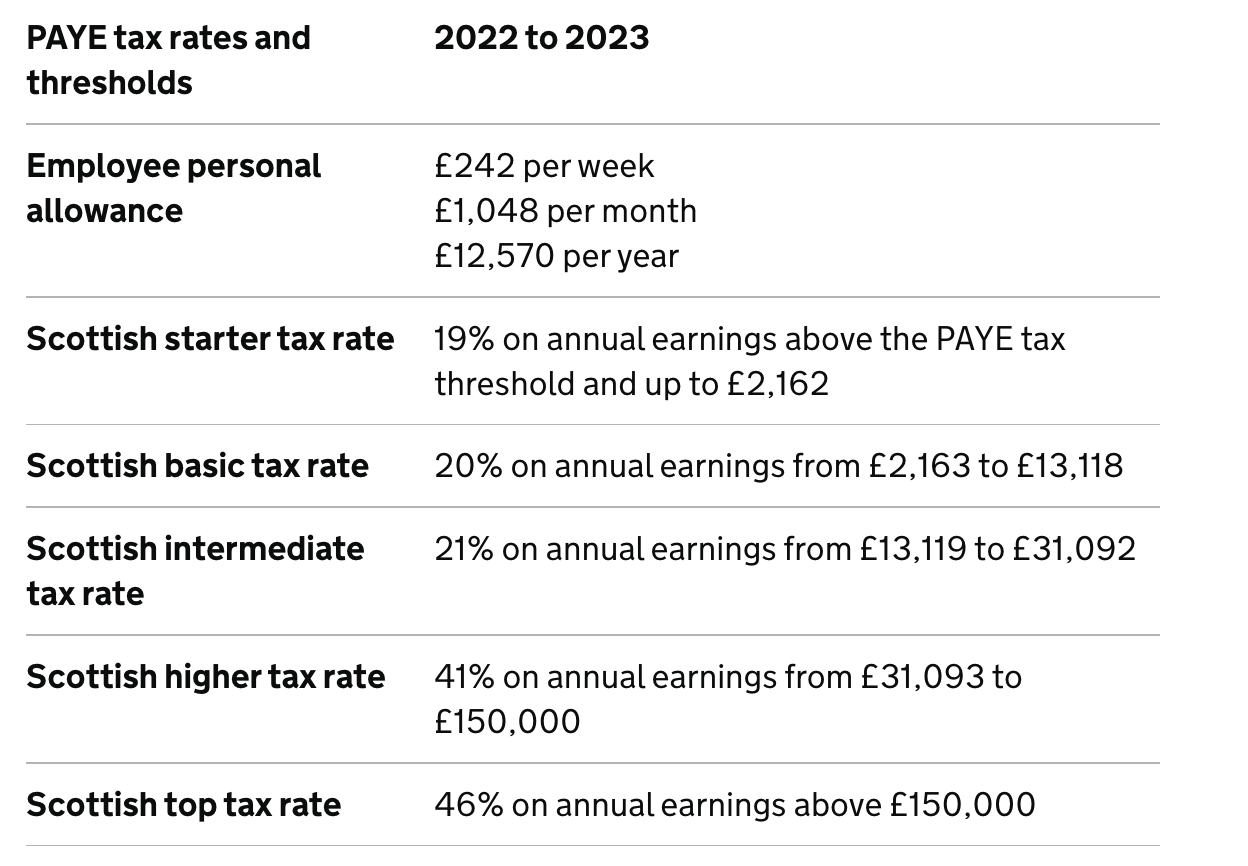

Scottish intermediate tax rate. Scottish starter rate - 2162 at 19 41078. Taxable income Scottish tax rate.

In this case you need to identify which is your main home. Taxable income Scottish tax rate. Scotlands Published Accounts.

Scotland Residents Income Tax Tables in 2022. The proposed rates and bands for Scottish income tax from 6 April 2022 are. If you are resident in Scotland your income tax calculation will be as follows.

If you are resident in Scotland your income tax calculation will be as follows. 20 on annual earnings from 2163 to 13118. Your Personal Allowance is.

Expected number and proportion of Scottish taxpayers by marginal rate 2022-23 Non-taxpayers. Scottish higher tax rate. Scottish Budget in 2022-23 is 565 Billion.

All Tax Calculators on iCalculator are updated with the latest Tax Rates and Personal Allowances for 202223 tax year. You may also pay Scottish Income Tax if you live in a home in Scotland and also have a home elsewhere in the UK. Scottish income tax rates 202223.

Scottish basic rate - 268 at 20 5360. Scottish basic rate - 268 at 20 5360. Those earning less than 27850 will pay slightly less income tax in 2022-23 than if they lived.

Income from 000. The current tax year is from 6 April 2022 to 5 April 2023. 11 Jul 2022.

The rate of Income Tax you pay depends on how much of your taxable income is above your Personal Allowance in the tax year. 21 on annual earnings from 13119 to 31092. D a higher rate of 41 charged on income above 31092 and up to a limit of 150000 and e a top rate of 46 charged on income above 150000.

Shows take-home pay after tax pension and includes the 2021 3 pay rise. Scotland Pay Consultation Following recent negotiations the Scottish Government has made a formal offer. Scottish basic tax rate.

The Scotland Act 2016 provides the Scottish Parliament with the power to set the Income Tax rates and bands that will apply to Scottish taxpayers non-savings non-dividend. Scottish starter rate - 2162 at 19 41078.

Contractor Salary Choosing A Tax Efficient Salary In 2022 23

Tax Rates And Thresholds For 2022 23 Brightpay Documentation

Scottish Welsh Income Tax Rates 2022 23 Confirmed Cipp

Tax Rates 2022 23 Tax Bands Explained Moneysavingexpert

Uk Income Tax Rates And Bands 2022 23 Freeagent

Payroll Year End Bulletin Spring 2022 Henderson Loggie

Uk Corporation Tax Rate 2022 23 Freeagent

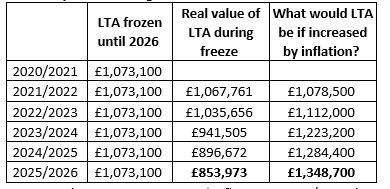

End Big Freeze On Income Tax And Pension Thresholds

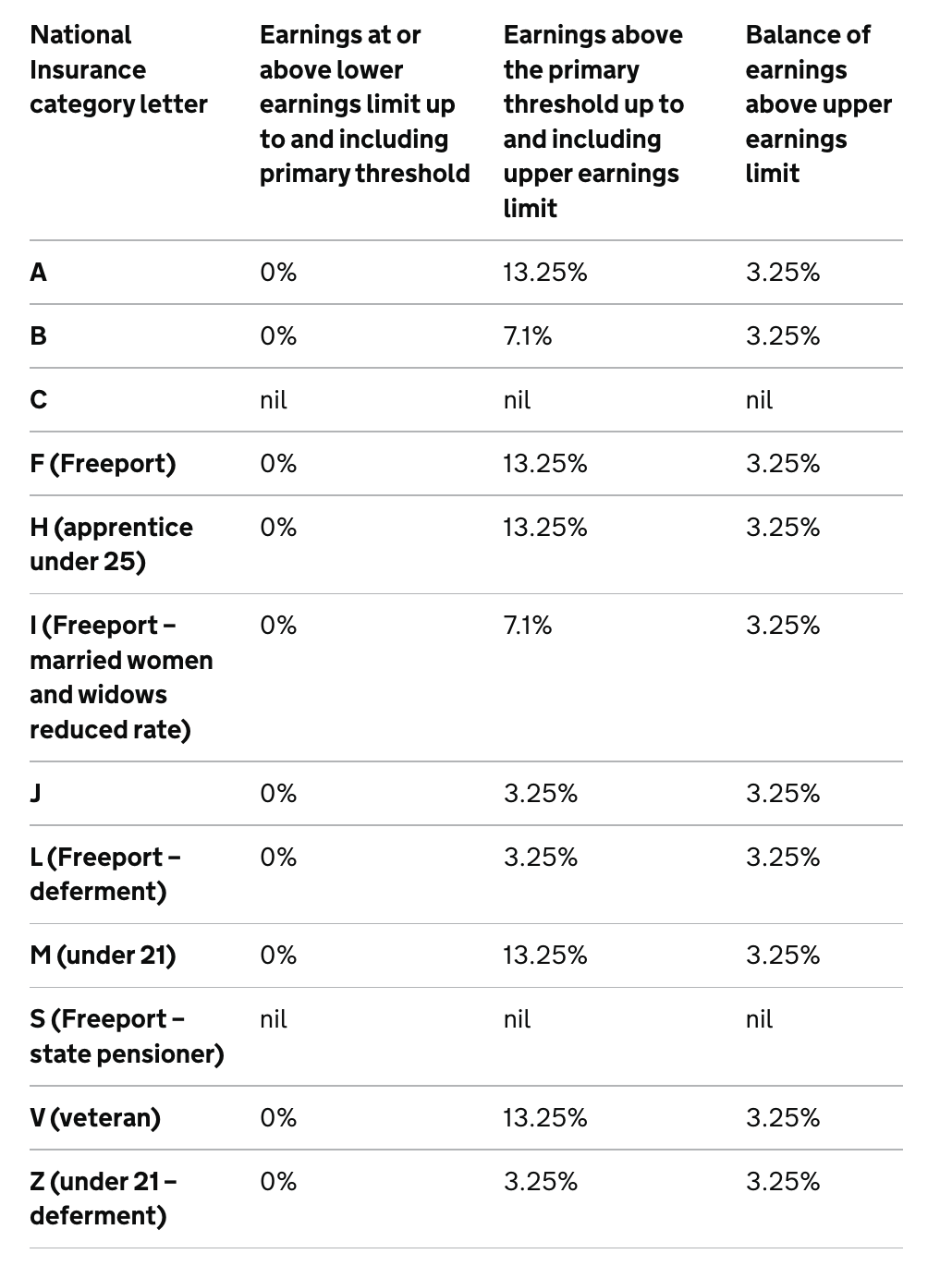

Nic Thresholds Rates For 2022 23 Brightpay Documentation

Income Tax Proposals In The Conservative Leadership Campaign Implications For The Scottish Budget Fai

Tax Rates And Thresholds For 2022 23 Brightpay Documentation

2022 23 Uk Income Tax And National Insurance Rates

2022 Spring Statement Brett Nicholls Associates

Scottish Fiscal Commission Scotfisccomm Twitter

Tax Year 2022 2023 Resources Payadvice Uk